views

Stock Market Today: S&P 500 Snaps 6-Day Win Streak; Dow, Nasdaq Slide as Tariff Relief Rally Fades

U.S. stocks closed lower on Tuesday, May 20, 2025, as investor optimism from recent tariff relief announcements began to wane. The S&P 500 ended its six-day winning streak, while the Dow Jones Industrial Average and Nasdaq Composite also posted declines. The market's retreat was attributed to renewed concerns over trade policies and their potential impact on the economy.Investopedia

Market Summary:

| Index | Close | Change | % Change |

|---|---|---|---|

| S&P 500 | 5,560.83 | -1.61 | -0.03% |

| Dow Jones Industrial Average | 40,527.62 | -2.24 | -0.01% |

| Nasdaq Composite | 17,461.32 | -2.40 | -0.02% |

Key Drivers:

-

Trade Policy Uncertainty: Investors expressed caution as the initial relief from tariff exemptions began to fade. While the U.S. and China had previously agreed to pause certain tariffs, uncertainties remained about the long-term stability of these agreements.

-

Economic Data: Mixed economic indicators contributed to investor apprehension. While some reports showed signs of economic resilience, others pointed to potential slowdowns, adding to the market's volatility.finance.yahoo.com

-

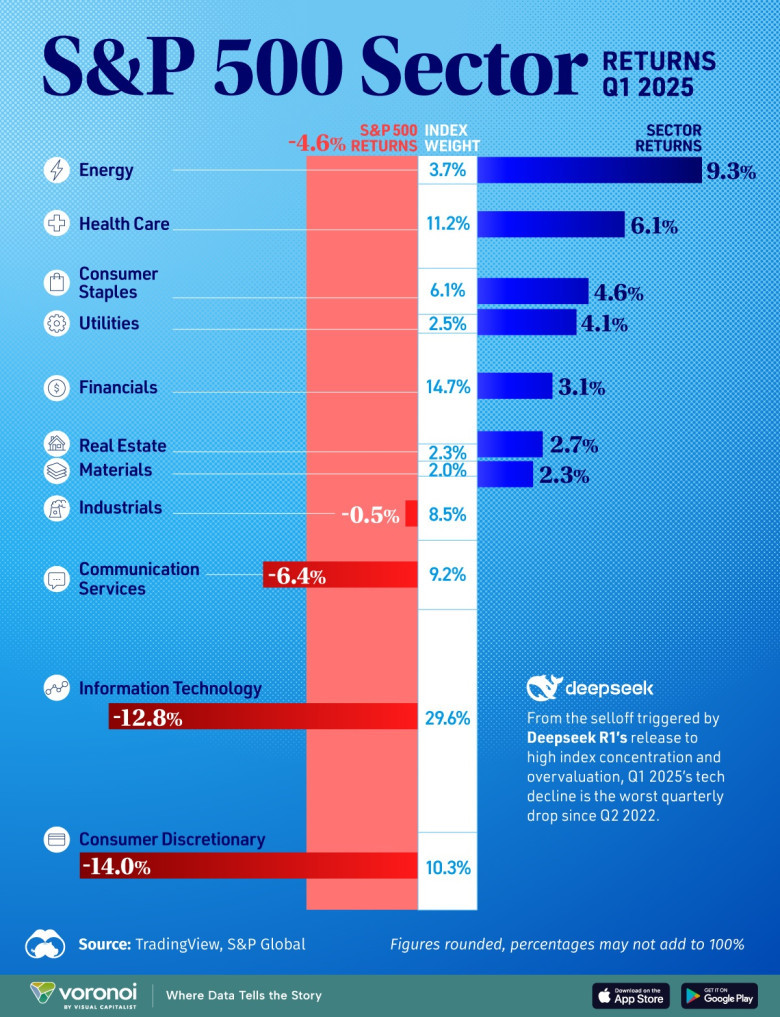

Sector Performance: Technology stocks, which had led recent gains, experienced profit-taking, contributing to the broader market decline. The Nasdaq Composite, heavily weighted with tech stocks, was particularly affected.

Outlook:

Market participants are closely monitoring developments in trade negotiations and economic data releases. Analysts suggest that while the initial optimism from tariff relief provided a boost, sustained market growth will depend on the resolution of trade tensions and clearer economic signals.

Investors are advised to stay informed about policy changes and economic reports that could influence market dynamics in the coming weeks.

Note: The information provided is based on data available as of May 20, 2025, and is subject to change as new developments occur.

Comments

0 comment