views

S&P 500 Faces Turbulence Amid Trade Tensions and Credit Downgrade

The S&P 500 experienced significant volatility in May 2025, influenced by escalating trade tensions, fiscal policy developments, and a historic credit rating downgrade.

Market Overview

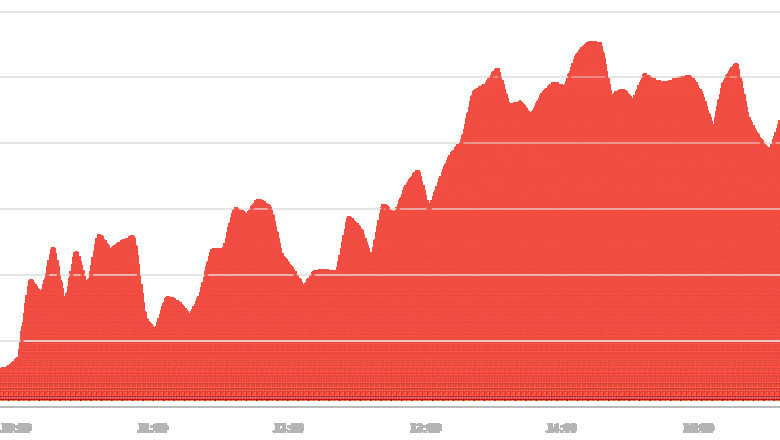

On May 23, President Trump announced a 50% tariff on all EU imports and a 25% tariff on foreign-manufactured smartphones, targeting companies like Apple and Samsung. This move, aimed at addressing stalled EU trade negotiations and criticized Apple for offshoring production, led to a 6% drop in Apple shares for the week. The S&P 500 mirrored this decline, falling 2.6% over the same period. en.wikipedia.org+1Barron's+1

The following day, May 24, saw a modest recovery, with the S&P 500 closing at 4,210.65, up from the previous day's low of 4,150.32. However, the market remained jittery, reflecting ongoing concerns about fiscal policy and its potential impact on economic stability.

Credit Rating Downgrade

Adding to the market's unease, Moody's downgraded the U.S. government's last remaining triple-A credit rating to Aa1 from Aaa, citing a long-term rise in government debt and interest payment ratios. This development caused U.S. stock futures to fall, with the S&P 500 decreasing by 230 points (0.5%) on May 25.

ETF Investment Surge

Despite significant market volatility, U.S. investors have funneled a record $437 billion into exchange-traded funds (ETFs), continuing a decade-long trend of moving away from mutual funds. Major beneficiaries include Vanguard’s S&P 500 ETF (VOO), which has already amassed $65 billion in inflows this year and may surpass its record $116 billion from 2024. WSJ

Market Outlook

Investors remain cautious, monitoring tariff developments and key economic reports like the upcoming core PCE inflation data. While the market showed some resilience amid recent volatility, concerns about fiscal policy, trade tensions, and credit ratings continue to weigh on investor sentiment.

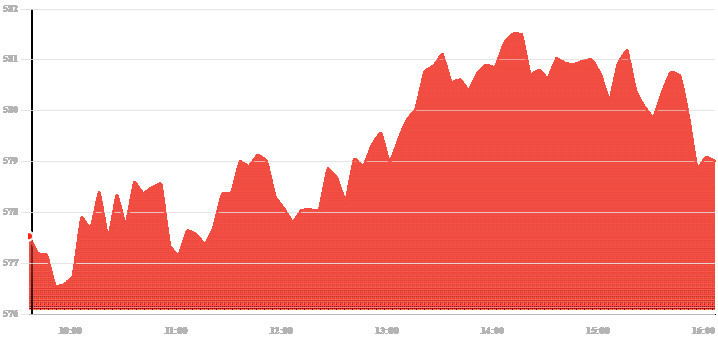

As of the latest data, the SPDR S&P 500 ETF Trust (SPY) is trading at $579.11, reflecting a slight decline from the previous close. The ETF's performance mirrors the broader market's response to the aforementioned economic and policy developments.

Investors are advised to stay informed about ongoing developments and consider their positions carefully in light of the current market uncertainties.

Comments

0 comment