views

Gold Prices Edge Higher Amid Market Uncertainty and Inflation Concerns

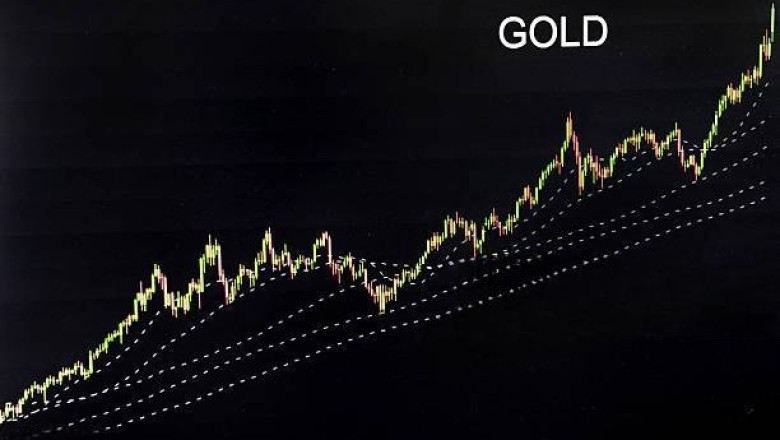

Gold, often regarded as a safe-haven asset, showed signs of renewed strength in May 2025 amid heightened market volatility, persistent inflation concerns, and geopolitical tensions. The Gold Continuous Contract (GC) — a widely followed benchmark representing futures contracts on gold — has attracted significant investor interest as a hedge against economic uncertainty.

Market Overview

On May 24, 2025, gold futures settled at $2,005.70 per ounce, marking a 1.5% increase from the beginning of the month when prices hovered around $1,975. The rise coincides with increasing inflation rates, a recent downgrade of the U.S. credit rating by Moody’s, and escalating trade tensions between the U.S. and European Union.

Investors are flocking to gold amid concerns over rising interest rates and volatile stock markets, with the CBOE Volatility Index (VIX) also rising sharply in recent weeks. Gold’s traditional role as a store of value during uncertain economic times has driven increased demand from institutional and retail buyers alike.

Table: Gold Continuous Contract Prices (May 20–24, 2025)

| Date | Open Price ($/oz) | Close Price ($/oz) | Daily Change ($) | Daily Change (%) |

|---|---|---|---|---|

| May 20, 2025 | 1,980.50 | 1,985.30 | +4.80 | +0.24% |

| May 21, 2025 | 1,985.30 | 1,993.50 | +8.20 | +0.41% |

| May 22, 2025 | 1,993.50 | 2,000.10 | +6.60 | +0.33% |

| May 23, 2025 | 2,000.10 | 2,003.40 | +3.30 | +0.17% |

| May 24, 2025 | 2,003.40 | 2,005.70 | +2.30 | +0.11% |

Data sourced from CME Group and MarketWatch

Drivers Behind Gold’s Rally

Several factors contributed to the gold price rally:

-

Inflation Pressures: The U.S. core Personal Consumption Expenditures (PCE) inflation index remains elevated, prompting fears that interest rates may stay higher for longer. Higher inflation typically boosts gold’s appeal as a non-yielding asset that preserves purchasing power.

-

U.S. Credit Downgrade: Moody’s decision to lower the U.S. credit rating to Aa1 has spurred concerns about fiscal sustainability and debt levels, enhancing gold’s safe-haven allure.

-

Geopolitical and Trade Tensions: Tariffs imposed on EU imports and electronics from abroad have raised fears of supply chain disruptions and economic slowdown, leading investors to seek refuge in gold.

-

Weakening Dollar: The U.S. dollar index has weakened slightly, making gold cheaper for holders of other currencies, thereby supporting demand.

Market Sentiment and Outlook

Gold’s momentum is expected to continue if inflation remains high and geopolitical risks persist. However, potential Federal Reserve rate hikes could temper gains, as higher real yields typically weigh on gold prices. Traders will closely monitor economic data releases and central bank communications for cues.

In summary, gold’s recent gains reflect a flight to safety amid an uncertain macroeconomic backdrop. Investors looking for portfolio diversification and inflation protection continue to view gold as a valuable asset in turbulent times.

Comments

0 comment